This Women’s History Month, it’s essential to expand the conversation beyond salary equality and delve into broader financial strategies that empower women to build lasting wealth. Equal pay is crucial, but true financial empowerment encompasses practices like investing, wealth management, and achieving financial independence.

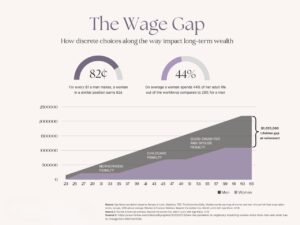

This guide provides actionable strategies to help women take control of their financial futures and make informed, strategic choices that support long-term growth. Encouragingly, Equal Pay Day continues to move earlier each year, a testament to progress in combating pay inequities. In 2025, Equal Pay Day falls on March 25, a symbolic reminder of the work still needed to achieve parity. Women lose over 1 million dollars in net worth over their lifetime due to the pay wage gap.

Here is What We can do!

- Prioritize Financial Independence

- Establish an Emergency Fund: Save at least three to six months of living expenses to protect against unforeseen financial challenges.

- Diversify Income Streams: Explore side hustles, entrepreneurship, or passive income opportunities to reduce dependence on a single source of income.

- Invest Early and Consistently

- Leverage Compounding: Begin investing as early as possible to take advantage of compounding growth. Do not be afraid of the market! A well diversified portfolio is what you need to grow your wealth.

- Understand Risk Tolerance: Work with a financial advisor to identify an investment strategy that aligns with your goals and comfort with risk.

- Consider Tax-Advantaged Accounts: Maximize contributions to retirement accounts like IRAs and 401(k)s to reduce taxable income while growing wealth.

- Embrace Financial Literacy

- Educate Yourself: Take courses, attend workshops, or read books on personal finance and investing.

- Seek Advice: Collaborate with trusted financial advisors or mentors who understand your goals and challenges. Work with a CFP Professional who is board certified to work through all the areas of your financial life.

- Utilize Tools: Use budgeting apps, investment platforms, and other resources to manage your finances effectively.

- Tailor Financial Strategies to Life Stages

- Single Women: Focus on building a solid financial foundation, including debt repayment and savings.

- Married or Partnered Women: Ensure joint financial goals are clear and establish personal financial autonomy.

- Widowed or Divorced Women: Seek specialized advice to manage wealth transitions and rebuild financial independence.

- Invest in Your Values

- Support Causes You Care About: Consider ESG (Environmental, Social, and Governance) or socially responsible investments.

- Philanthropy: Create a giving strategy that aligns with your personal and financial goals.

- Build a Support Network

- Women’s Financial Groups: Join organizations or communities that focus on women’s financial empowerment.

- Accountability Partners: Work with friends or family members to stay motivated and focused on financial goals.

Building wealth is about more than achieving equal pay; it’s about making deliberate, informed decisions that empower women to secure their financial futures. This Women’s History Month, take the opportunity to assess your financial strategy, seek support, and make strides toward your financial goals.

Empowered women empower wealth. Being financially independent or free is the biggest gift you can give yourself. Start your journey today.