No more late nights worrying about your future.

At this point in my career:

I Am An RIA

I Work For A Wirehouse

I Am a Licensed IAR

I Work For An

Insurance Company

I Am A Financial Planner

I Am a Retirement Planner

A SHIFT in the Wealth Management Industry

ASHTON THOMAS FOR RIAS

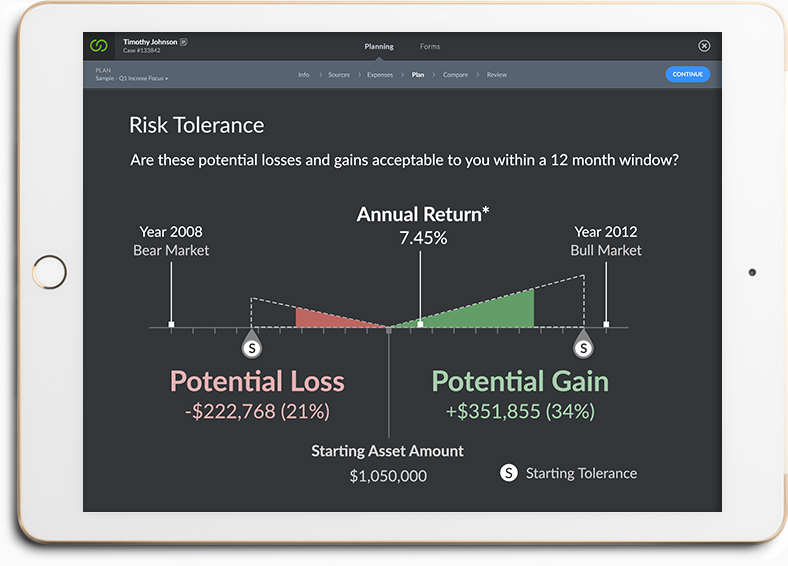

Our digital ecosystem, Ashton Thomas AMPLIFY™, is reshaping the vision of wealth management and can help you achieve advisory excellence while managing your growing business. Whether you’re a successful firm that wants to reach the next level of success, or an up-and-coming firm looking to build a strong foundation, Ashton Thomas AMPLIFY™ can help enrich all aspects of your practice—brand consulting, business development, technology tools, operational resources and organizational continuity—allowing you to meet the needs of your growing business in this digital age.

A SHIFT in the Wealth Management Industry

ASHTON THOMAS FOR ADVISORS

Today the wealth management landscape has become increasingly crowded making it more difficult for you to differentiate yourself from the competition. Are you asking yourself, “How can I find the right clients and grow my business?” Partnering with Ashton Thomas means access to not only industry-leading technology, but to a whole team of professionals—advisors, investment analysts, operations experts, practice management authorities and much more. These professionals have extensive experience in every facet of your practice and are committed to helping you stay ahead of the competition. Together, we’ll identify how you can maximize your time and opportunities, so that you spend more time with the people and projects that expand and enhance your business.

Are You A GOOD Fit?

YOUR FUTURE LOOKS BRIGHT WITH ASHTON THOMAS

We partner with highly-successful financial advisors who are excited about working as part of an entrepreneurial team to build a new kind of wealth advisory. If you share our client-centric, values-based culture, we will provide what you need to achieve your personal benchmarks.

We think differently about wealth management—challenging the status quo and constantly pushing for reinvention. We believe success is not an entitlement—it has to be earned every day. Ashton Thomas thrives not just because of our investment advice, but because we’re at our best when we are creating enduring relationships and personal connections.

At Ashton Thomas, you have the opportunity to make a difference. You have a voice and the ability to create a legacy. If you are one of the select, accomplished advisors, then welcome home to the Ashton Thomas team.